New at SPAR 2007 was an Owner/Operator Roundtable. “Our objective was to gain insight into the owner/operator community,” explained Tad Fry, Manager of Engineering, Brewing Operations & Technology, Engineering Group, Anheuser-Busch, who facilitated the roundtable. “Why do we use this technology” – 3D laser scanning? “How are we using it? What are some execution methods? And most important – what are the challenges and unique requirements of owners in adopting this technology?”

Practitioners and project managers from 23 asset owner organizations met and exchanged experiences and requirements in a closed-door working session during the conference. Members of this group then shared their findings with other attendees in an open panel discussion. The roundtable agenda emerged from results of a Spar Point survey of O/Os that investigated business drivers, usage patterns, constraints on adoption – and what solution developers, service providers, EPCs and owners themselves can do to help O/Os accelerate deployment of the technology and get the most value from their investments.

Business drivers

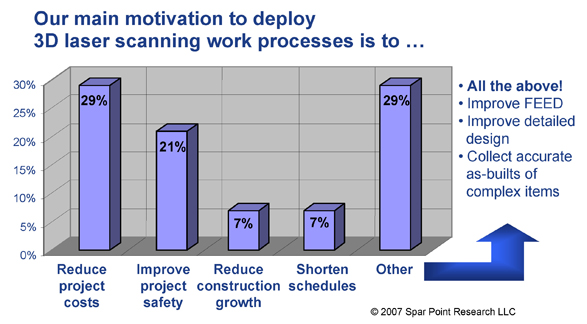

Reducing project execution cost was the most often cited business driver for O/Os deploying 3D laser scanning – of the 17 organizations responding to the survey, 29% named this as their main motivation. Also important was improving project safety (21% of respondents), followed by reducing construction growth (7%) and shortening schedules (7%).

Nearly three-quarters (74%) of survey respondents reported that they or someone in their organization had used 3D laser scanning to execute a capital project in the past 24 months. Twenty-one percent had not; 5% weren’t sure. Fully 80% reported their organization planned to use 3D laser scanning in the next 12 months.

Continued

Where laser scanning is used in the asset lifecycle

The design phase is where O/Os reported 3D laser scanning is used most often in project execution – 79% of survey respondents use laser scanning to improve design. Fabrication and construction is also big – 57% use it here. Half use it in project planning, and 29% are using laser scanning for asset management.

Brownfield work (revamps, retrofits, modernizations) accounted for 93% of all laser scanning use reported – only 7% was in greenfield projects.

How laser scanning services are procured

O/Os procure laser scanning services from all available sources. Twenty-nine percent of respondents report they have developed in-house resources to execute laser scanning – an encouragingly high percentage of owners. Another 21% use specialist service providers, 14% use their EPC contractors, and 38% use several or all of these.

Continued

Adoption constraints and accelerators

Low awareness of laser scanning’s business value inside owner organizations was the most often cited barrier to greater adoption. High cost and poor integration with existing IT infrastructure were the next most frequently named constraints. Finally, a requirement that owners raised over and over was the need for faster, more automated creation of CAD geometry from point cloud data.

Needed from hardware and software vendors

What can hardware manufacturers and software developers do to help accelerate adoption and acceptance? Panelists and survey respondents identified better integration between point-cloud data and CAD tools as one of the most important things. Transportation industry O/Os expressed this as the need for better integration with their mapping/geospatial applications.

The survey and roundtable identified a number of specific data-related needs for solution developers to work on:

- “Smart clouds” – easier, faster, more automated processing of scan data into target deliverables of all kinds

- Geometry compatible with 3D plant design systems

- Lightweight 3D geometry

- Solids models

- Standards to foster interoperability and data exchange

- Standard specifically for raw scan data import/export analogous to LAS format for airborne LIDAR data

- Standard schemas and terminology

- Smaller file sizes with no compromise in resolution or other data attributes – handling today’s point clouds requires upper-end computer configurations

- Highly compressed data format for efficient archiving

Continued

Needed from service providers

How can an organization be sure that a laser scanning service provider is qualified to provide complete and accurate deliverables, other than trial and error? That was one of the most important owner needs regarding service providers. Can the industry “develop a system for validating or certifying the abilities and qualifications of service providers,” as one participant put it? Performance guarantees or warrantees from service providers would also help.

Owners identified further ways that service providers can support their efforts:

- “Help our capital project teams by demonstrating the value this technology brings to projects (i.e., money saved through the use of laser scanning) so that we can sell our business partners on using it”

- “Provide on-site QA/QC plan for surveying and setting control grids, calibration methods and requirements, data collection/scan registration process”

- “Provide clear definition of accuracy (error resolution methods) for scan models”

- “Submit checklist of customer requirements – what information the service provider needs from the client to make their scanning effort successful”

- “Develop an on-site process that drastically reduces the amount of time spent laser scanning and surveying, thus reducing cost”

Needed from EPCs

What can EPCs do to support owners? Laser scanning saves engineering effort hours, owners observed – it’s important for EPCs to find the most effective ways to demonstrate these savings, and to maximize the extent to which savings can be passed on to the owner.

Improving construction with laser scanning was a big focus of what owners expect from EPCs. Construction contractors need to “trust and embrace this technology,” as one phrased it. For this to happen, “a paradigm shift will be required within the contractor community. This includes planners, management and trades. Workflows will change and new tools will be introduced. These items will enhance bidding, planning and productivity abilities for their companies.” But that will require “education of our contractors” about laser scanning, as another owner put it. “They like what they see,” but many “just don’t know how to use it” yet.

Needed from O/Os

What about owner/operators themselves? Heading the list of what O/Os said they need to focus on is increasing management buy-in by better communicating the business value of the technology.

Capturing relevant project metrics is one key to this:

- Cost – direct laser scanning costs versus total project savings demonstrates the value created

- Schedule – enhanced performance

- Safety – enhanced performance

- Quality improvements – in data, workflow, deliverables, etc.

Helping the industry develop and promulgate standards is another way that owners identified they could help themselves. Useful standards would address:

- Interoperability

- Data accuracy, especially as it influences ease of post-scan processing

- Workflows and best practices – planning, education and training

- Qualification of users – EPCs, service providers, even O/O staff

Continued

Survey demographics

Spar Point’s owner/operator survey was conducted in March 2007. Responses were obtained from 17 organizations. (Note that not all questions were answered by all respondents.) Industry demographics of responding organizations were as follows:

- 37% process/power

- 37% civil, building, transportation

- 16% discrete manufacturing (automotive, aerospace, shipbuilding, etc.)

- 10% other

Owner/Operator Roundtable panelists at SPAR 2007 were Deborah Deats, Design and Document Team Leader, BP Texas City; Ron Frederiks, Mapping Technologist, New York State DOT; Calvin Kam, National 3D-4D-BIM Program Manager, U.S. General Services Administration; Sean McDaniels, Imagery/LIDAR Supervisor, Nevada DOT; and Shawn Roy, Land Surveyor II, Michigan DOT. The panel was moderated by Tad Fry, Manager of Engineering, Brewing Operations & Technology, Anheuser-Busch.

Participants in the closed-door O/O Roundtable working session included individuals from Alcoa, Ameren, Anheuser-Busch, Chevron Phillips Chemical Company, Crazy Horse Memorial, Diesel Locomotive Works, DTE Energy Services, Dow Chemical, DuPont, ExxonMobil, Federal Highway Administration, Frontier Drilling, U.S. General Services Administration, General Motors, Lockheed Martin Space Systems, Michigan DOT, Nevada DOT, New York State DOT, NYC Tech, Ohio DOT, Rhodia, Utah DOT and U.S. Army Corps of Engineers.

Owner/Operator Roundtable 2007 participants and others from the O/O community have expressed interest in continuing the work started at this year’s event. If you are employed by an asset owner/operator and would like to participate in future Owner/Operator Roundtable activities, please contact Tom Greaves at [email protected] or tel. 978-774-1102.

.jpg.small.400x400.jpg)