Real estate is the world’s largest asset class comprising commercial, industrial, and residential properties. Worth an estimated $230 trillion, the global real estate market is more than three times the estimated value of all global equities combined. With more than four billion buildings worldwide, the built world is the largest undisrupted market with less than 1% digitized.

Is should be no surprise that there are several companies that have taken aim at filling this technological void – specifically through 3D scanning and photogrammetry aimed at real estate applications. Earlier this week, it was announced that 3D camera and software company Matterport was in talks and taking steps to become a publicly-traded company, making it the first big player in the space.

Matterport, Inc., the spatial data company leading the digital transformation of the built world, and Gores Holdings VI, a special purpose acquisition company sponsored by an affiliate of The Gores Group, LLC, today announced that they have entered into a definitive agreement providing for a business combination that will result in Matterport becoming a publicly listed company. Upon closing of the proposed transaction, the combined company will be named “Matterport, Inc.” and intends to remain listed on NASDAQ under the ticker symbol “MTTR.” -Matterport Press Release, February 8, 2021

Matterport’s cameras and applications help realtors (as well as architects, building and facility owners) quickly get buildings online and in a shareable 3D tour format. Matterport’s proprietary AI technology, Cortex can automatically creates a dimensionally accurate, photo-realistic, three-dimensional digital twin of any building that is loaded with spatial data. The software can be used with a variety of cameras, including Matterport’s own cameras, as well as the Leica BLK360 and Ricoh 3D cameras, and has recently been added to an iPad application, lowering costs and broadening the accessibility of the technology.

For some not familiar with the company, the reported $2.9 billion equity value for Matterport may have come as a surprise for a niche 3D technology company. But Matterport has been growing steadily since their founding in 2011. What has been growing just as fast, however, is the public’s desire to be able to access more representative experiences of potential property purchases from their own homes. With Matterport tours ability to be embedded on real estate website listings directly, their presence is becoming more common, more useful, and ultimately more expected.

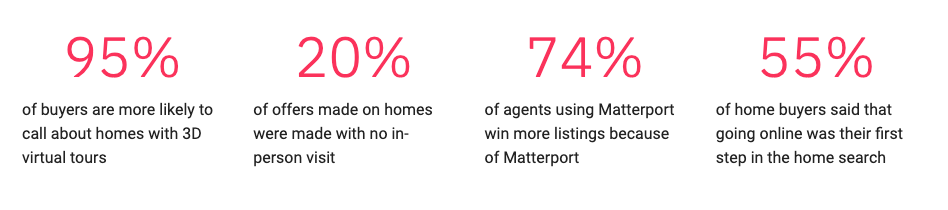

Before the pandemic, there was already a strong interest in 3D tours for the real estate market, with a report from Matterport in 2019 finding that 95% of home buyers are more likely to call a real estate agent if the listing has a 3D tour, and with 74% of agents reporting that they are able to win more listings when they include a 3D virtual listing.

The necessity for social distancing, as well as the continuing trend of shopping online for real estate, has only increased this interest in a virtual vs. an in-person tour. In the 2020 Home Buyers and Sellers Generational Trends Report, from the National Association of Realtors, nearly half of the respondents (46%) indicated that virtual tours were “very useful” when using online resources to look for a home, up from the previous year (42%) saying the same.

While there are other virtual tour companies that have come out of the real estate business and moved into 3D, Matterport seems to have the advantage in that it started out putting their expertise into reality capture and digital twins, and then found the applications and use cases that best fit the technology they developed.

All and all, it will be interesting to see what other 3D technologies can be applied to help nurture this growing desire from consumers to see more than static photos.