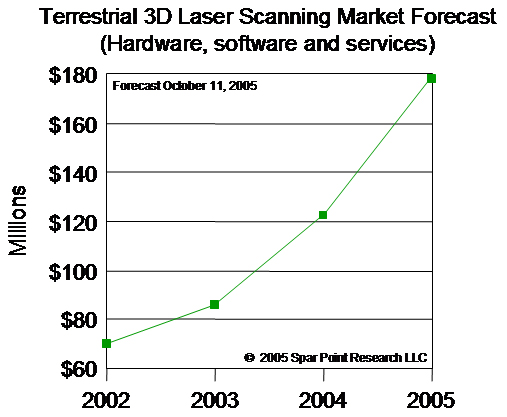

Sales of terrestrial 3D laser scanning hardware, software and services will reach $178 million in 2005, according to our latest forecast – a growth of 45% over 2004. We have raised our May 2005 forecast of $168 million, itself a sharp upward revision of our initial forecast made in late 2003, due to better visibility into the market by all our sources now that the year is further along. Guidance from laser scanner manufacturers was backed up by our interviews with software and service providers, who report high activity levels in a broad variety of markets ranging from civil infrastructure to process and power, ship and boat building, forensic, automotive manufacturing and others.

All indicators are that strong growth will continue for the foreseeable future. Practitioners and vendors agree the market has moved from early adopters to the beginnings of mainstream acceptance, driven by spreading recognition of how improved dimensional control aids design, fabrication, construction, operations and maintenance. Further spurring growth, we believe, will be new hardware and software technologies now in development – we see no signs of softening in the industry’s R&D investments. All this makes laser scanning something of a rarity in the technology sector – an industry where it’s pedal-to-the-metal time.

Methodology

Sources – In developing market estimates, Spar Point’s practice is to seek guidance from executives at the subject companies. However, most of the companies herein are privately held and thus have no obligation to report revenue or other business information. Three of the companies are publicly traded; however, of these only Leica Geosystems reports revenue for its 3D laser scanning business in any detail. We have made some effort to validate our estimates with customers, partners and other independent sources, but in most cases the data is difficult or impossible to verify.

Revenue vs. user spending – Market totals represent the sum of vendor revenue, not user spending. The market total is inflated compared with user spending because it includes intra-industry OEM sales by Z+F to Leica Geosystems HDS, but deflated compared with user spending because it excludes dealer markups due to equipment resale.

Caveats

Growth fluctuations – The 3D laser scanner industry is a capital equipment business whose product release cycles are often longer than one year. This can result in irregular growth year-over-year.

Disclaimer – This information is based on the most reliable data obtainable by Spar Point at the time of publication. However, the information is furnished on the express understanding that unless otherwise indicated, it has not been independently verified and may contain material errors. Readers are cautioned not to rely on the information in forming judgments about a company or its products, or in making purchase decisions. The information is not intended for use in the investor market, defined as an individual/entity whose principal use of the information is for the purpose of making investment decisions in the securities of companies covered directly or indirectly by the information. In the event of error, Spar Point’s sole responsibility shall be to correct such error in succeeding editions of this publication. Before using the information please contact Spar Point to ensure it is the most recent version.

Hardware market-share forecasts coming later this month. Also watch for our INTERGEO 2005 trip report.

This information is excerpted from Spar Point’s publication Capturing Existing Conditions with Terrestrial Laser Scanning: A Report on Opportunities, Challenges and Best Practices for Owners, Operators, Engineering/Construction Contractors and Surveyors of Built Assets and Civil Infrastructure. More information including hardware market-share forecasts for 2005, hardware/software/service breakdowns, vendor profiles and cost justification is available by subscribing to this publication. To subscribe or learn more, click the link above or contact Tom Greaves at tel. +1 978.774.1102 or email [email protected]. geovisit();