FY2013 showing big gains in revenue, profit for Topcon

Japan-based Topcon Corporation reported Friday a 19 percent jump in sales for the first nine months of FY2013 to ¥79.3 billion (US$774.2 million), generating net profit of ¥2.2 billion ($21.9 million), a big turnaround from the ¥1.6 billion ($15.2 million) net loss in the same period last year.

Publicly traded Topcon, founded in 1932, trades on the Tokyo Stock Exchange and generates over $1 billion in annual sales. North American sales for the April 1-Dec. 31 period soared 31 percent for the parent company of Livermore, Calif.-based Topcon Positioning Systems Inc. (TPS) to ¥31.4 billion ($306.2 million).

Operating profit for the North American region, during the nine-month period, was ¥2.9 billion ($28.3 million), far exceeding last year’s operating profit of ¥742 million ($7.2 million) in the same period last year.

TPS is the world’s largest manufacturer of precision GPS and GNSS systems, commercial lasers, and optical instruments for the global surveying, civil engineering, asset management, mapping, construction, agriculture and mobile control industries.

Topcon’s “Mid-Term Business Plan 2015” released last June laid out growth strategies for its Smart Infrastructure segment, which focuses on 3D measurement, surveying instruments, and mobile mapping systems, and its Positioning (TPS) segment, which focuses on GPS, machine control system, and precision agriculture. Topcon’s third business segment is Eye Care.

The Positioning segment’s net sales for the April 1-Dec. 31 period totaled ¥33.2 billion ($323.5 million), an increase of 30 percent. Segment operating income for the nine-month period amounted to ¥2.2 billion ($21.6 million).

The strategy for TPS, led by CEO Raymond O’Connor, is to use technology from its core GNSS (global navigation satellite system) business for rapid expansion in IT construction (also referred to as machine control), but will invest “most heavily” in IT, or precision, agriculture.

Topcon also wants to accelerate the OEM business for both construction and agriculture equipment manufacturers. TPS said it is launching affordable models of GPS products for the Asian market, such as a GNSS receiver with advanced tracking technology and machine control products such as the world’s smallest auto steering system.

Smart Infrastructure strategy

The Smart Infrastructure segment generated net sales for the nine-month period of ¥23.4 billion ($228.6 million), nearly 20 percent higher. Segment operating income stood at ¥2.9 billion ($28.5 million) for the period April 1 through Dec. 31.

The strategy for Smart Infrastructure is to “enhance new business with strong basis of surveying instruments.” Specifically, Topcon plans to:

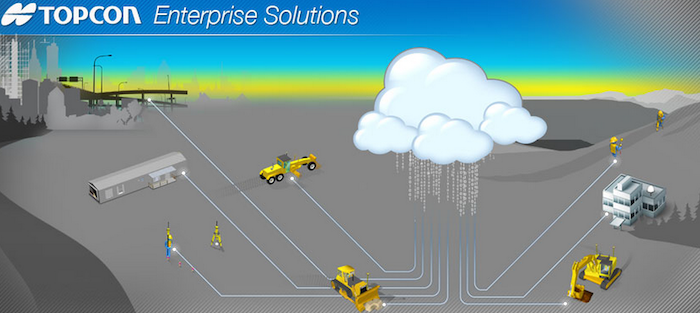

- promote to its core business, the Survey/Construction/Building sector, with an estimated market size of $1 billion (¥100 billion), the world’s first surveying instruments management system business to use cloud computing and adopt the industry’s first automated manufacturing system

- enter the US$300 million (¥30 billion) Building Information Modeling (BIM) market with the “world’s first BIM-specialized product” and cultivate new BIM markets, including 3D measurement, through its 2012 collaboration with Autodesk

- introduce the “world’s first specialized products for construction work sites” in the Construction Information Modeling (CIM) market, valued at US$300 million (¥30 billion)

- launch innovative sensors that can cover multiple varieties of agricultural products in the sensor supply business for the Precision Agriculture sector, estimated at US$100 million (¥10 billion)

Year-end outlook

Topcon said it expects to generate a 13 percent increase in FY2013, ending March 31, revenue to ¥110 billion ($1.1 billion). Net income is slated to come in at ¥5 billion ($48.8 million), a whopping 877 percent over FY2012.