‘As soon as I saw the results, I thought, ‘Wow, this could be something for us’”

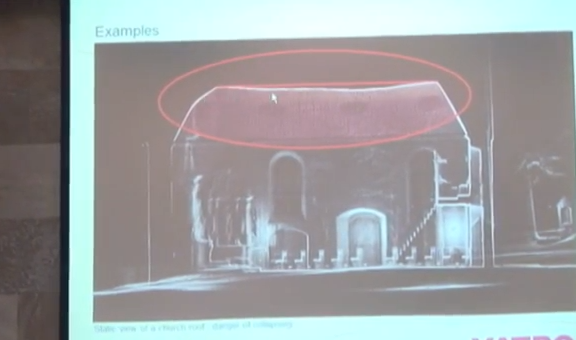

THE HAGUE, The Netherlands – If you’re looking to document the actual state of a piece of property at a particular point in time, it’s hard to beat 3D laser scanning. Perhaps it should be obvious, then, that insurance companies are increasingly using laser scanning to document the state of assets they’re insuring, setting a baseline for value and obligation.

“It’s totally different,” said Lothar Brummel as part of his presentation here at SPAR Europe, “from walking around with a pencil, a legal pad, and maybe some pictures.”

Brummel is general manager, marketing, for VATRO Trocknungs und Sanierungstechnik GmbH & Co., a firm with 34 locations across Germany that specializes in helping companies recover from water and fire damage, working closely with insurance companies on managing claims and making sure clients are fairly compensated for the damage they suffer.

He told the audience at SPAR Europe that once he learned of laser scanning’s capabilities, he quickly sent employees to school for laser scanning and took advantage of the training provided by Z+F, which introduced him to the technology.

“As soon as I saw the results laser scanning could create,” said Brummel, “I thought, ‘Wow, this could be something for us and something revolutionary for the insurance industry.’”

Z+F’s Forensic department head Jörg Meixner was the one who made that introduction between laser scanning and VATRO, back in 2008. After seeing how the police and forensics communities embraced laser scanning, we came to see how insurance could benefit as well. “Why should insurance companies use laser scanning?” he asked rhetorically. “Because it provides an objective 3D dataset of the insured company. They know definitively what they are insuring. All insured assets are documented and there’s no arguing over whether something was brought in later. It was either there, or it wasn’t.”

“My house is insured,” he joked, “and they asked me to send a picture of my house. What are they going to do with a picture of the front of my house?”

Meixner said even the psychological effect of laser scanning can be beneficial for insurance providers. “If the company owner knows all of his assets are documented, he knows the insurance company knows what he has and what is insured,” he said. “He’s less likely to take risks.”

In the following video, Meixner and Brummel discuss some specific laser scanning applications for the insurance industry:

Looking toward the future, Brummel said that only a small percentage of insurance companies are currently working with scan data, but that it was likely to quickly increase once they learn of the technology. Further, he foresaw other 3D data capture technologies working into the mix.

“Let’s say you’re working with a factory,” he postulated. “If you have a lot of tooling machines, maybe the machine costs one million euro and the tools for the machines cost the same amount. You could take the large laser scanner from Z+F to document the machines and then the handheld scanner from Mantis Vision [which uses structured light technology]to document the condition of the tools in the drawers … Then the guy from the insurance company clicks on the icon over the drawer, opens up the drawer virtually, and he can count the tools in there and what they look like. Are they heavily corroded?”

Are we there right now? No. But, Brummel said, “The picture I’ll need to provide in two years has to be much better than the ones of today.”