There’s been a lot of focus over the last few years around autonomous solutions in the construction industry, with that word “autonomous” meaning different things to different people. Some might immediately think of autonomous heavy machinery, but more often we’re talking about back-end processes and other types of autonomy, which can be just as valuable. That said, generally we’re hearing about these things from the companies who are making these autonomous tools, which certainly has its value. On the other hand, it’s important to also hear from those who would benefit from these tools about what they’re experiencing.

Hexagon apparently felt the same way, and they recently released an extensive survey around autonomy in construction. The survey was taken by just over 1000 respondents from within the industry, all of whom as a requirement for participation have responsibility for technology decisions in their company or organization. Respondents were from North America (with an even split of respondents from Canada and the United States), Australia, and the United Kingdom. It’s worth noting before we get into the results below that 701 of the respondents were from North America, while 203 were from Australia and 100 from the UK.

Furthermore, more than half of the respondents were either in a company’s C-Suite or a Director/Senior Manager; there was a roughly even split between public and private companies in the responses, with a slight skew towards public; companies with between 1000 and 5000 employees were the largest representation in company size, though companies as small as less than 500 employees and as large as over 10,000 were represented; revenue ranged from less than $50 million per year to over $1 billion, with the largest range represented being between $250 million and $499.99 million; and every company participates in commercial construction, with nearly half indicating participation in residential as well.

Okay, so with that demographic information out of the way, I’d like to dive into just a few of the findings from this survey which stood out the most to me. This is just scratching the surface of what Hexagon found in their 20-question survey, and I’d certainly encourage you to click the link above to read the whole thing.

There were a few things which stood out to me even before we get into the autonomy piece of it all. The survey, for example, started with questions about how companies dealt with the pandemic and how they were affected by the “turbulence.” Unsurprisingly, most respondents said they were “significantly” affected, with “completely” affected coming in slightly higher than “moderately” affected. That’s true for every industry, I would think.

However, what was more surprising to me was that most respondents indicated that they at least somewhat agree that they have the technological systems in place to help adapt to turbulence, take advantage of new opportunities, and manage negative impacts quickly and effectively. In fact, nearly no one disagreed with that, as just 0.3 percent said they “strongly” disagreed and only 1.4 percent saying they “somewhat” disagreed. This kind of flies in the face of the construction industry’s reputation.

Now, some of this might be selection bias - the respondents by definition are responsible for making these technology decisions, so of course they’re going to say they’ve made good decisions. Even with that in mind, the results are so skewed in that direction that mostly I think this is just another point in favor of the idea that construction’s reputation around technological adoption is outdated. Is there room to grow still? Of course. But we don’t need to keep talking like it’s 20 years ago.

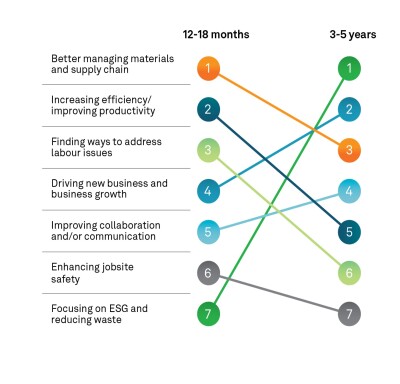

One other quick non-autonomy observation, since it’s just about Earth Day as we publish this: It’s notable to me that, when asked about top three priorities to improve business performance over the next 12-18 months, focus on ESG and reducing waste had the lowest response rate at 29 percent, but when asked the same question about a three-to-five year timeframe, it had the highest response rate.

There are reasonable explanations for this. We’re coming off that aforementioned period of turbulence, and companies are focused on digging themselves out of those holes. ESG and waste-related solutions also take longer to implement, especially for an industry like construction which has such an outsized impact on the environment and so many established workflows. With all of that said, though, I find it hard to escape the reality that kicking the environmental can down the road, so to speak, has long been standard practice across many industries, and is among the reasons we find ourselves in our current position.

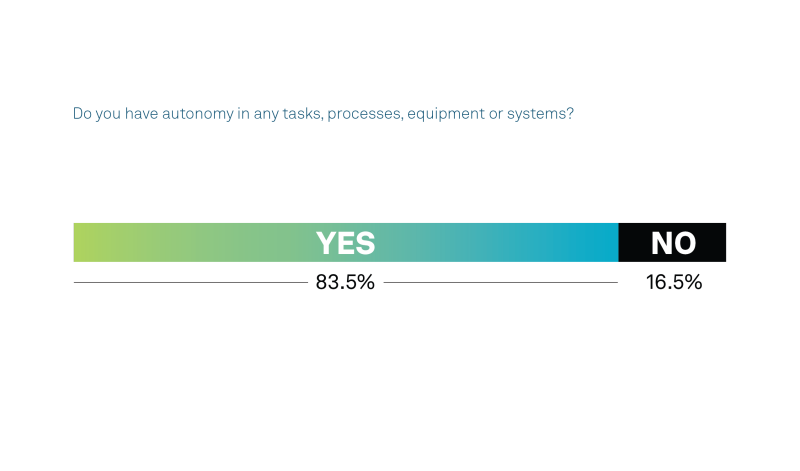

Finally, as we get into the autonomous piece of the survey, I was initially surprised to see that a whopping 83 percent of respondents indicated that their company or organization already utilizes some sort of autonomous or automated technology. This gets back to the point from the top of this article, that autonomous construction is generally associated with machinery.

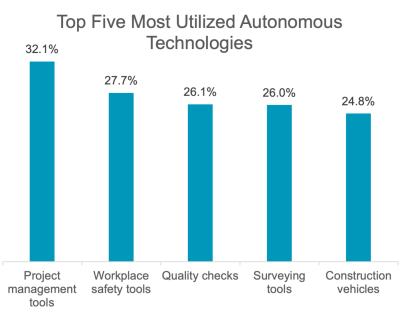

Of course, that’s not what we’re talking about here. Instead, project management tools were the number one example given of what types of autonomous tools, although another interesting piece of this survey is how different regions broke down. For example, the project management tools being number one was largely driven by 35 percent of North American respondents choosing that answer compared to just 21 percent from the UK and 26 percent from Australia. On the other side, the UK had an outsized representation of automated surveying tools, while Australia was a bit more balanced, slightly leading the way in terms of workplace safety tools.

One final observation with respect to autonomy is that, when asked what benefits have been gained from using autonomous technology, respondents from the UK answered "better supply chain mapping" far lower than the other two groups. This comes despite the fact that they had the highest rate of response for saying procurement and supply chain was among their top three business challenges or pain points.

I'm not sure I can pinpoint a reason for this - my guess is that there is some geographic and/or political/regulatory circumstances which exacerbate supply chain issues in the UK - but it does explain why, when asked how much of a direct or indirect bottom line impact benefits from autonomous tools have made on the business, answers skewed lower in the UK at the highest ends of that rating scale.

There’s so much more to unpack from this comprehensive survey – hesitancy around AI is the biggest hesitation around autonomy, 79 percent of organizations plan to invest in autonomous technology over the next three years, with that number being consistent across the three polled locations, as just a couple of examples – and I highly encourage people to find more insights that I may have overlooked. But one overarching takeaway is that, while there may be disagreements over what will be most positively impacted, what initial focuses will be, and how much investment is enough, autonomous tools – and technology in general – of all kinds are only going to become more important in construction. And those in the industry know it, whether their reputation backs that up or not.