3D plant design software manufacturer eyes nuclear new-builds in China, India

AVEVA Group plc, a provider of 3D engineering design and information management software to the process plant, power and marine industries, on Monday reported record revenue for fiscal year 2013 of $344.5 million (£220.2 million), a 12 percent increase over the previous year.

The Cambridge, U.K.-based company said profit for the year ended March 31 was $71.1 million (£45.5 million), a 13 percent increase over last year.

“We expect to see further growth in the oil and gas industry in coming years and a solid demand backdrop in power, underpinned by nuclear new‑build in China and India, in particular,” the company said in its annual report.

AVEVA operates two businesses:

Engineering & Design Systems (EDS) provides software solutions for the design and construction of assets in the plant, power and marine industries.

EDS revenue grew 10 percent to a record $296.4 million (£189.5 million) in fiscal year 2013, driven by sustained demand from the company’s Engineering, Procurement and Construction (EPC) customers and global growth trends in oil and gas and power industries, but the marine segment “remained subdued.”

AVEVA said it saw particularly strong demand from the oil and gas market as customers become involved in “increasingly complex projects, some of which are the largest ever undertaken, necessitating additional design hours and more licences of our 3D design software tools.”

Enterprise Solutions (ES) provides software and support for ongoing information management throughout an asset’s lifecycle.

ES moved into profitability for the first time in fiscal year 2013 with revenue up 31 percent to a record $48 million (£30.7 million), contributing $3.1 million (£2 million) to the company’s bottom line.

The division also released what the company calls “one of the most significant new products” in its history, AVEVA E3D. The software for major capital engineering projects lets engineering, procurement and construction contractors “break down barriers between design and construction, reducing overall project cost, compressing schedules and mitigating risk.”

The division’s flagship AVEVA NET software creates a central repository for all project and asset information to support processes from material management, planning and scheduling, project management, handover, operations and maintenance, through to decommissioning.

“We achieved against challenging targets in ES during the year, and now the division is positioned for profitable growth in a rapidly expanding market,” the company said.

AVEVA uses a subscription-based license business model, meaning customers pay a fee for ongoing access to its software, providing a “strong recurring revenue base for AVEVA, which allows us to invest in the future development of our products and markets.”

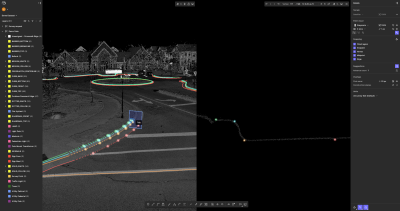

AVEVA’s LFM Software launched new laser scanning software products in April called LFM server and Operating Modes for efficient workflow to maximize the use of 3D data for the plant, power and marine industries.

The company acquired LFM from Zoller+Fröhlich (Z+F) in October 2011. LFM Software is called hardware and software vendor neutral, meaning it has the ability to accept data from all brands of 3D laser scanners, and exporting to 3D integrated plant design systems, CAD and Review platforms.

AVEVA’s verticals

Oil & Gas

AVEVA’s primary growth industry is the global oil and gas industry with an increase in the number, size and complexity of projects worldwide as global energy demand is expected to grow 36 percent from 2011–2030 with an increasing proportion of the supply to be satisfied by difficult to exploit deep‑water fields, the company said.

“This drives up design hours and the use of AVEVA’s software tools for ever more complex engineering and design,” AVEVA said.

Power

The company said it also has a strong market position in the global power market, which has long investment cycles.

“We are strongly positioned to benefit from new nuclear projects in China, where the nuclear build program has recently recommenced, and in India, where nuclear is a key part of the government’s long‑term power infrastructure build program.

The World Nuclear Association report that over half of the 480 proposed or planned new builds will be located in China and India by 2030.

Marine

The marine industry is also traditionally a key area of strength although the industry is currently in a cyclical downturn for another two years, offset partially by offshore projects.

AVEVA also sells into related industries, including chemicals, pharmaceuticals, metals and mining, processing, pulp and paper and other specialist manufacturing sectors.

Total revenue from end user markets included:

- Oil & Gas: 45-50 percent

- Marine: 20-25 percent

- Power: 15 percent

- Other (Mining, Petrochemical, Chemical and Paper and Pulp): 10-20 percent

AVEVA around the world

AVEVA, with 48 offices worldwide, said it is seeing “rapid expansion” in the world’s fastest growing economies, particularly India and China.

EMEA

Close to half of AVEVA’s annual revenue, $168.4 million (£107.6 million), a 15 percent increase in sales over the previous year, came from EMEA (Europe, Middle East and Africa).

The company attributes the increase to stronger demand from larger global EPCs and plant owner operators and “strong, regional performance” in the United Kingdom, Russia, and the Middle East.

Asia Pacific

AVEVA’s Asia Pacific region generated a third of company revenue or $114.7 million (£73.3 million) during fiscal year 2013, a 14 percent increase over last year.

“In Asia Pacific, we saw good progress in China, particularly in the second half of the year, with strong license growth compared to a year ago – despite the continued weakness in marine,” AVEVA said. “Our investment in India during the year has begun to bear fruit, with an acceleration in the volume of deals.”

During the year, AVEVA opened a new research and development center in Hyderabad, India and a new office in Mumbai.

Americas

The company’s revenue from the Americas region for the year was $61.5 million (£39.3 million), up 17.8 percent.

Overall performance in the region was impacted by project delays in Brazil, but the company said regional growth opportunities were substantial, citing increased activity in North America with its rapidly expanding Canadian presence.

“We anticipate a return to growth in Latin America as project delays subside and the spending freeze unwinds,” AVEVA said. “China and Southeast Asia are well positioned to deliver further good growth and we will continue to invest in growing our presence in the world’s developing economies.”

Over the past five years, AVEVA has invested nearly $234.7 million (£150 million) in research and development, with $55.5 million (£35.5 million) invested in fiscal year 2013.

In related news, AVEVA is proposing to return $156.5 million (£100 million) to shareholders in the form of a special dividend, subject to shareholder approval at its annual meeting July 9.