This week we take a look at the market for ground penetrating radar (GPR), a technology used to image underground existing conditions. Recent advances in sensor technology and data processing capabilities suggest to us that GPR usage is likely to increase significantly. Late last year we interviewed a small sample of engineering managers as well as senior executives of GPR supplier companies to get their views about where this market is headed and why. Here’s what we found:

What is GPR?

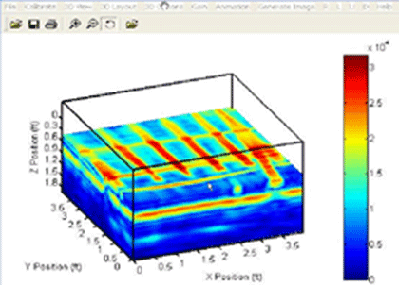

Ground penetrating radar systems work by sending an electromagnetic wave into the ground. The wave propagates in the ground until it is scattered by a change in the electrical or magnetic properties of the earth – the scattered signal is then measured at the surface. Don’t delude yourself, the underlying physics is very complex. Sophisticated data processing is required to image subsurface conditions and extract depth information.

GPR technology works well in certain underground conditions, dry sand for example and poorly in other conditions, salt-saturated Louisiana gumbo for example. In many places soil conditions vary significantly over short distances which makes it tough to predict in advance whether or not GPR will yield meaningful results.

Market size and growth rate

We estimate that currently the annual worldwide market for commercial GPR solutions and software is less than $50 million and is growing between 10% and 15% annually. This estimate is consistent with the estimates provided by top executives of leading suppliers of GPR hardware and services, and is consistent with productivity expected from manufacturing firms of the size found in this industry. Note that this estimate does not include dealer markups. Why such a coarse estimate? For starters, the major suppliers of commercial GPR systems don’t disclose this information. Two of the three major suppliers are privately held and the third is a relatively small subsidiary of a publicly traded firm. We estimate the market for associated services is easily 5 to 10 times the size of the market for hardware and software solutions.

Some industry contacts indicated the market for non-commercial GPR solutions may be as large as that for commercial solutions. However, we have little visibility into the procurement of GPR and related seismic/acoustic and other electromagnetic sensing solutions by military and other government organizations.

Key suppliers of commercial GPR systems include Geophysical Survey Systems, Inc., Mala GeoScience USA, Inc., and Sensors & Software Inc. geovisit();geovisit();

What’s driving growth of GPR?

In North America there is an increased tendency to bury communications and utility infrastructure underground — the density of underground infrastructure is increasing. Consequently the need to locate existing underground assets to avoid service interruption in advance of installing new underground assets is acute. This is reflected in “dig safe” legislation enacted in many if not all states. Current GIS databases of existing underground assets are often inadequate to locate these assets with the confidence required for engineering and construction purposes. Hence it is often necessary to locate these assets in advance of excavation.

Another important application driving demand is the use of GPR for non- destructive analysis of concrete. The combination of deteriorating highway infrastructure and growing traffic numbers means an increased need for high speed data collection, particularly if lane closings can be reduced.

In the process industries, demand for underground sensing and imaging solutions increases when there are issues of soil contamination. Reliable knowledge of the location of underground piping and tankage is required for revamp work which may require connection to these assets or simply avoidance for purposes such as driving piles. Soil vacuuming is an expensive alternative to reliable underground imaging. If the vacuumed soil is contaminated, it has to be incinerated, an very expensive process. Our discussions with engineering firm executives with first-hand experience suggest that granular knowledge of underground asset location is often key to project go/no-go decisions. geovisit();

What’s holding GPR back?

GPR growth is inhibited by the strong dependence of the value of GPR solutions on soil conditions, which vary widely by geography. GPR devices are perceived to be near useless in Louisiana gumbo or Texas clay because of the dielectric properties of these soils. The US Department of Agriculture publishes a map of GPR suitability in the upper meter of soil. However, the dielectric properties of soil can vary widely over a few hundreds of meters. Thus the applicability of today’s technology cannot be determined reliably in advance, which in turn constrains demand.

Engineering managers we interviewed pointed to other reasons for their unwillingness to invest in the technology. One reason was that today’s GPR systems are perceived to deliver images laden with ambiguity: “you need to be an expert, like a radiologist, to interpret the squiggles.” This ambiguity limits application for using the data for design purposes, as the interpretation expertise is limited to the interpretation skills of the human collecting the data in the field. Closely related is the limitation of most of today’s GPR software systems to pass engineering- and survey- grade data to CAD applications or geographic information systems (GIS). This is an area of development for GPR suppliers as well as others.

Mark Klusza, CEO of BitWyse Solutions, sees commonality between the data processing and management of subsurface data and laser scanning data. According to Klusza, the ability to visualize and navigate GPR and other EM data in a design/construction CAD environment will drive industry growth.

One supplier we interviewed pointed out that the lack of an economic connection between utility outage caused by digging into an underground asset and the consequent loss of service can inhibit adoption. For example, the economic loss felt when telephone service is interrupted is borne mainly by the consumer and there is no remedy to recover this loss from the service provider. Absent this remedy, the incentive to invest more in preventative measures such as the use of GPR systems is muted. Contractual liability for service loss is shunted to the digging party — the backhoe owner/operator who is least able to compensate economic losses resulting from service interruptions and least able to invest in underground imaging solutions. However, this kind of impact varies widely by industry. The exposure of gas pipeline companies to economic losses caused by loss of service or safety hazards may well be greater than that experienced by suppliers of telephone services.

One supplier of GPR software and hardware solutions also pointed to Federal Communications Commission (FCC) regulations governing power output of GPR systems as an inhibitor of growth. More signal power means better and deeper resolution. FCC limitations on GPR output power are part of FCC authorization of ultra-wideband technology.

What’s coming

Look for improved integration between design, i.e. CAD and GIS, and GPR post-processing technologies. This will unlock the value of GPR and other underground sensor data. geovisit();