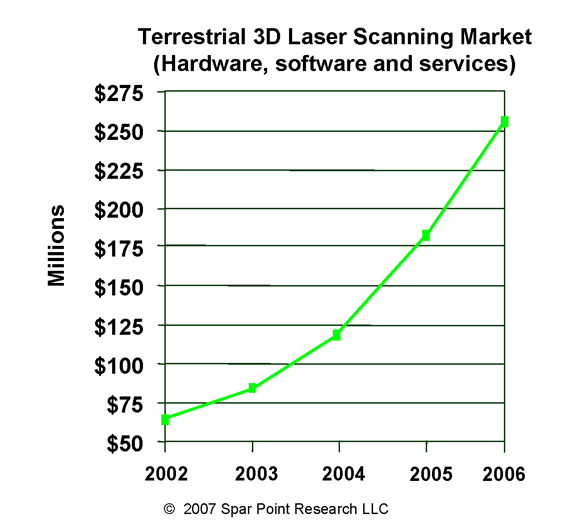

Sales of terrestrial 3D laser scanning hardware, software and services reached $253 million in 2006, according to our latest estimate – a growth of 43% over 2005. Guidance from laser scanner manufacturers was backed up by reports from software and service providers of strong activity across many markets – offshore construction and repair, onshore oil and gas, fossil and nuclear power, civil and transportation infrastructure, building, automotive and construction equipment manufacturing, shipbuilding, forensic – the list goes on.

Growth shows no sign of abating in the foreseeable future. Customers and vendors agree the market has moved well beyond early adoption into substantial numbers of mainstream users, driven by case after case where improved dimensional control aided design, fabrication and construction, operations and maintenance. Growing investments in laser scanning technology and work process by asset owner/operators is one notable marker of this, we believe.

Beyond better-informed design and engineering, more and more practitioners are driving use of optical measurement to improve construction in both brownfield and greenfield projects. Modular construction, dimensional control and digital fit-up of fabricated items, integration of airborne LIDAR with GPS/RTK with conventional survey, and intelligent application of 3D visualization are yielding impressive results in an industry well known for its reluctance to change. New research in using survey-integrated video, flash LADAR, RFID and other sensor technologies for real-time site monitoring suggests we’ve only seen the beginnings of all that’s possible here.

Looking ahead, the potential of 3D laser scanning and related measurement, positioning and dimensional control technologies to improve asset management could dwarf the value delivered thus far for design and construction – tapping this value will require continued investment by solution developers and practitioners alike.

Methodology

Our practice is to estimate hardware and associated revenues through a sequence of conversations with top executives at all the suppliers. We test these estimates with some round-robin polling and again in the market with service providers, engineering companies and asset owner/operators. However, most companies in this market are privately held and thus have no obligation to report revenue or other business information. Two of the hardware providers are publicly traded, but neither reports revenue for its 3D laser scanning business in any detail. Thus there is no way to know how much uncertainty to ascribe to our estimates.

Nevertheless, we believe these estimates are valuable in helping current and prospective customers determine who the market leaders are. For these purposes, small differences in market share are less important than knowing who the bigger players are and who the smaller players are – this information is in some respects a proxy for geographic reach, likelihood of acquisition, development resources and other decision criteria. Also, having some sense of the market’s size and growth rate helps customers gauge the appropriateness of their investments. Of course market estimates are only one decision factor – technical performance, service and support quality, interoperability with existing infrastructure and others are equally or more important.

Disclaimer: This information is based on the most reliable data obtainable by Spar Point at the time of publication. However, the information is furnished on the express understanding that unless otherwise indicated, it has not been independently verified and may contain material errors. Readers are cautioned not to rely on the information in forming judgments about a company or its products, or in making purchase decisions. The information is not intended for use in the investor market, defined as an individual/entity whose principal use of the information is for the purpose of making investment decisions in the securities of companies covered directly or indirectly by the information. In the event of error, Spar Point’s sole responsibility shall be to correct such error in succeeding editions of this publication. Before using the information please contact Spar Point to ensure it is the most recent version.

.jpg.small.400x400.jpg)