Arius 3D, a manufacturer of short-range scanners and software and a 3D image library solution, publicly traded on the TSX and based in Mississauga, Ontario, announced it’s looking to raise about $1.2 million with a brokered private placement.

You can read the details here (units, common shares, exercise price, blah, blah), but the basic gist is that “the proceeds of the Offering will be used for 3D Image content creation, and working capital,” and that at least $200k of that is going to come from the CEO and a director. That’s not generally the best sign in the world, but that’s one of the reasons a small company sets up as public, so that it has interesting financing options. This way, if the CEO and director are going to kick in money, at least they get more equity and have some options to get cheap shares later should the company blow-up (in a good way).

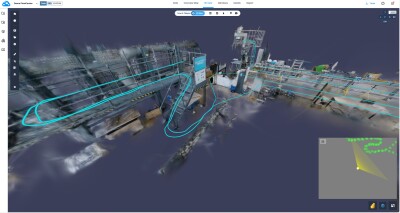

And Arius does have an interesting business model – whether there’s demand for it or not: “The Arius3D technology supports wide-ranging applications in culture and heritage, entertainment, education and product design with a primary focus of generating image license recurring revenues from rich media content.”

I think I can see a world where, instead of textbooks, schools are buying multi-media licenses that allow them access to educationally designed media. That media would be licensed by the access provider and the original owners of the content – the Smithsonian, say – would get a recurring revenue from the access provider. Essentially, when I’m teaching about the Civil War, instead of having kids read from a textbook with some pictures in it, I have them log onto a web site and rotate around a 3D image of a Civil War-era cannonball that was used to bombard Fort Sumter.

The business model isn’t quite proving lucrative yet. Their financials (cool stock symbol, by the way: LZR) aren’t exactly pretty: $1.25 million in revenue against an operating cash flow of -$2.4 million and a reported net loss of $5 million last year. Debt isn’t too bad, at $1.83 million, but not great either.

Although those revenue numbers don’t quite jibe with this press release which seems to report much more revenue (along with the appointment of the current CEO), back in November. Something might be screwy there. Yahoo Finance isn’t always the best with small companies.

Regardless, they’re one of the few pure-play 3D imaging firms out there, and worth watching. Should they be able to establish a significant business model with 3D image licensing, that could lead to some interesting new developments in the market. Would video games license the 3D BIM of a cool new sports stadium? Would travel apps license the 3D scan of historic locations? Would 3D printing houses license 3D scans of objects for knick-knack reproduction?

Plenty to think about there.