As I have mentioned in past articles, I am no longer with SmartGeoMetrics (SGM) and have moved to a (predominately) engineering firm by the name of Ragan-Smith (RSA). While at SGM I had the luxury of pulling whatever scanning equipment I needed from one of the largest hardware inventories in the business. While my resources in general are much larger at RSA, my scanning hardware resources are lessened a bit.

Now, I think we can all agree that there has never been a better time for those of us looking to buy new scanning hardware. With both FARO and Leica announcing sub-$25k systems and a thriving pre-owned market, we have more options–with a lower cost of entry–than ever before. However, the combination of these two facts has me wondering how best to apply reality capture in this ever-changing environment.

The Market Rates are Changing

If there is one thing I learned in the GPS boom of the ’90s, it’s that lower hardware prices + lower costs of entry = lower rates for services. Add to this the fact that more clients are able to use point clouds natively and you also remove what was once a large service invoice from the equation as well. Don’t get me wrong, I totally understand, and I’m actually welcoming the fact that new market verticals will be coming online as these technologies cease to be cost-prohibitive. However, I’m not sure how to best address the issue. If you have scanners that you paid $100k to own and you are bidding against a guy that has $25k invested, how do you determine the market rate; and what does that market rate include, service-wise?

I started off scanning with a two rate system; one rate for field scanning time and another for data processing (registration/modeling/CAD extraction/etc.) Later, as more clients requested a point cloud deliverable, I started rolling registration into the field rate instead of lowering the field rate. Modeling and additional deliverables were still added on, but this worked well, as most of my projects were lump sum and this made it simple for the client by reducing variables and unnecessary information.

A Leica C10–or the unlikely answer to Sam’s problem.

However, in the engineering world I now provide a lot more rate sheets for MSAs and a lot fewer lump-sum proposals. If a client looks at my bid sheet and it says “$250 hr. for scanning (includes registration)” and my competitor’s says “$200 hr. for scanning” and then in another section says “$90 hr. for point cloud processing,” I’m pretty sure the client will come away thinking that I am the more expensive of the two. In some cases, I may be, depending upon the registration method and so on, but either way, it’s an “apples to oranges” comparison that most clients will miss.

The issue I struggle with is, “how do you charge more for scanning than a survey crew when a scanner costs the same as a total station?” The short answer is that the field work is only part of the equation and the technical expertise needed is of value as well. But, those are variables that can seem like an excuse more than a reason to a client’s ears.

Perhaps, one answer is to treat them like a survey crew from a field-methodology approach. In an attempt to fit into a client’s rate sheet this past month I rethought the entire approach to scanning—and it may be time for me to eat a bit of humble pie.

Traverse

The Value of Digging Deeper

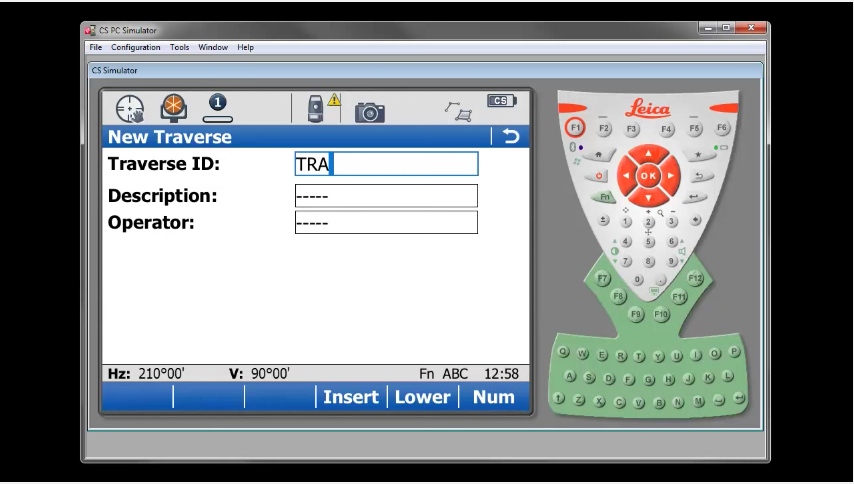

For years I have disparaged Leica’s onboard Traverse and Resection tools, as I had Cyclone’s Virtual Surveyor tool. I viewed them as marketing gimmicks to hook land surveyors into scanning. Gimmicks that, in my opinion, kept these surveyors from learning the better methods of data capture and field methodologies that I had learned from marine and offshore scanning techs–guys who looked at land surveyors as crude measurement guys with dirt on their boots! While reviewing the aforementioned project, I found myself with a Leica C10 instead of a closet full of multiple scanners from multiple manufacturers. I also found myself with a rate sheet that billed scanning at something close to a survey crew. As a result, I started digging deeper into the capabilities of the C10, as my normal Target to Target method would simply take too long to be profitable within the structure of the project.

In this first case, we went with the onboard traverse method. I now have survey crews, so we had them set up a couple of points from which to launch the project and a couple of more to tie into at the end of the run. Having to acquire the foresight and backsight in the field added three to four minutes to each scan, but the finished project imports into Cyclone already registered. By using Scan Control, you can go through and work the Traverse Report if necessary but we’ve done close to ten so far without an error that eclipsed the scope of work. Best of all, this removes another task from the point cloud processing staff, which somehow, remains the bottleneck in most firms.

The entire process bakes a bit more time into the field (which is at a higher billable rate than office time) but reduces processing billable hours so that the cost is less to the client but at a higher per hour margin to me. It requires fewer targets (lower equipment needs and less to manage in the field) and shortens the overall turn-around time. It’s about as “win-win” as you can get.

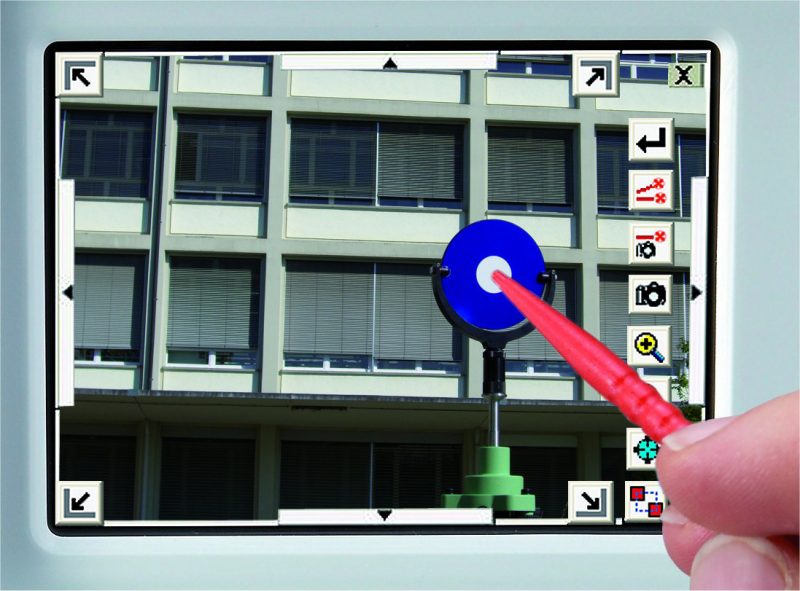

Resectioning

Lesson Learned

Since then I have had similar results using the resection tool for construction monitoring projects. Those clients seem to like the fact that the invoice roughly reflects the time they know you were onsite. And, managing 3-4 targets in an active construction zone is much easier than running around moving 8-10 targets all day long or using a ton of disposable targets.

I’m still on the fence when it comes to rate sheets and how to move forward with what I think are the inevitable pricing adjustments to come. However, I feel a bit foolish for cherry picking equipment for their sweet spot over the years instead of digging deeper and empirically testing each command in the help indices. Another thing I learned in the GPS boom was that when prices go down, so do a lot of operators that get away with being sloppy due to the wide profit margins. As those margins decrease, we are all going to have to dig a bit deeper and use every capability in the hardware and software we own to stay in the game.