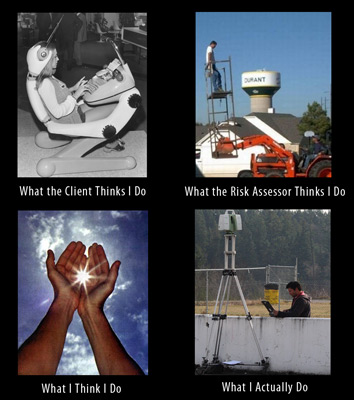

Growing up there were a lot of things I wanted to do in my life. Worrying about insurance was not one of them. However, getting to know insurance and your insurance provider can have a big impact on your profitability. As a surveyor I was initially interested in errors & omissions policies, but when it comes to money, liability policies are where I now focus. The problem is simple: I think I am asked to carry way too much liability insurance in order to get approval to enter a job site. If you feel the same way, it is probably because what you are going to do onsite, and what your insurance provider (and your client’s law department) think you are going to do, are quite different. I have come to understand that what policies are required are determined by what category of operation you find yourself in; that determination is often performed by someone that wouldn’t know a laser scanner from a blowtorch.

I’ll give you an example. Last week we scanned an automobile racetrack. In order to access the track we were asked to provide a very large general liability policy and additional liability policies in the amount of $1,000,000.00 USD per person! Once it was explained that we would not be racing, but imaging and measuring the track, they were willing to waive the $1M per person coverage mandate (provided we didn’t drive over 40 mph). One call, a little civil discourse, some education, and a nice little reduction in the cost (and increase in profit) of the project.

Often, it is not so easy. This is where being on a first-name basis with your insurance agent comes in handy. The asset owner’s representative knows that you do not want to pay for insurance you do not already have. However, they assume that your insurance provider is a 3rd-party broker that is more than happy to sell you more services. While that may be true, your provider also wants to keep you as a long-term customer, which means you staying in business (and that requires work & profits). This is a way your agent can help you realize both. Make sure that your agent understands what you do. If the asset owner’s representative is being asked to categorize you and the two closest boxes they can check on their paperwork are an “engineering service” or a “photographer,” which do you think is going to require less insurance? Having an insurance agent that can vouch that what you do (and what past clients have accepted for liability insurance) is closer to camera work than anything that requires power tools can help sway a risk mitigation person that is on the fence about how to classify your level of risk. Then, of course, take the time to thank your agent for their help. You probably are not surprised to hear that expressions of gratitude are less than daily occurrences at most insurance offices. A little can go a long way next time around.

Another consideration harkens back to my post “You Do What Now?”. Just using the term laser in your title makes you seem much riskier than using a term like 3D Imaging. They are both the same practice, and you are not being misleading, but the difference in perception to the uninitiated can be great. I have found that using phrases like imaging, camera, mapping, and digitizing are far better at reducing the anxiety of asset owners than laser, non-destructive, data capture, phase based and other aggressive sounding terms.

All of that being said, there are times when you just have to suck it up and pay to play. I understand why it takes a fair amount of insurance to work in a nuclear power plant. I just don’t think you should need a comparable amount to work on the shoulder of an empty racetrack.