As a result of the webinar we conducted yesterday (click to listen) with Leica Geosystems’ Mike Harvey and Nobles Consulting Group’s Fred Bermudez, we’ve been inundated with follow-up questions. Some are very specific: My target pole doesn’t seem to be working right – think I need a new one? Others are much more big picture.

I just wanted to pass along one question and answer that I think gets to the heart of the issues that surveying firms face as they contemplate making the leap into laser scanning.

First, the question:

How do we get started in marketing or presenting the benefits of the laser scanning and justify the cost of the data when we could shoot the site with a reflectorless total station for way less? I understand that they are getting way more information, but how do you sell the future harvesting of data as a benefit?

Actually, there was a bit more to the question, but that was the heart of it. Now, let me pass along Mike Harvey’s answer, because it really reflects the bits and pieces of advice I’ve heard from a lot of other survey firms in the industry, and pulls it together in a nice little package:

————

How to sell to the customer:

Back when I was surveying, the initial thought in my company was to market the heck out of the scanner to a) get jobs for it and b) pay for the scanner. I can’t stress enough this is a colossally flawed thought process. By some stroke of luck, I did get a ‘first job’ for the scanner and I was a complete, and utterly nasty disaster. So bad that I nearly lost my job over it, not to mention we never heard from that client ever again. However, in hindsight, this was one of the best learning experiences I could have had. Immediately, I stopped marketing it, and just used the scanner on projects that I already had in house. I didn’t use it on the whole job, just a portion. By doing this I was able to master the processes needed to efficiently produce deliverables with a scanner. One MUST keep in mind the scanner is another tool in the toolbox, and not a end-all be-all thing. Once I was comfortable with the scanner (and I had familiarized a crew with scanning) I started to market again. This time, I was able to speak from experience. The next opportunity did come, and now with my knowledge, I aced the project. Not to mention we got LOTS of return work. (BONUS!)

Pricing:

In my experience, the scanner lends itself to lump sum projects. I did try hourly or daily rates, but that is a massive risk for failure before you have fully traveled through the learning curve. Typically, I would price the job by using conventional rates, shave 10% off, and that was the price. I would agree with you that it is possible (depending on circumstance) for conventional gear to be just as fast as a scanner on very small sites, but on larger sites, there is no way a total station can even compete. Remember, a scanner will locate a 300’+ diameter of data in under 7 minutes. There isn’t a piece of conventional gear that can come even close to that. Furthermore, a scanner will allow companies to take on projects that they typically would turn down because of scope and tight time frames. Full elevation drawings, BIM, Plant / Piping, etc are projects that just aren’t cut out for conventional gear. The true value in the scanner (to you) is the drastic time savings in collecting the data. A customer once challenged me to scan, and make a rough topo plan, all in one day. I was able to scan a site that was about 1.5 acres, and then produce a plan all in the same day. Obviously, I was omitting property lines, but still this client confessed that what I did in one day would take his crews 2-3 days to complete.

Deliverables:

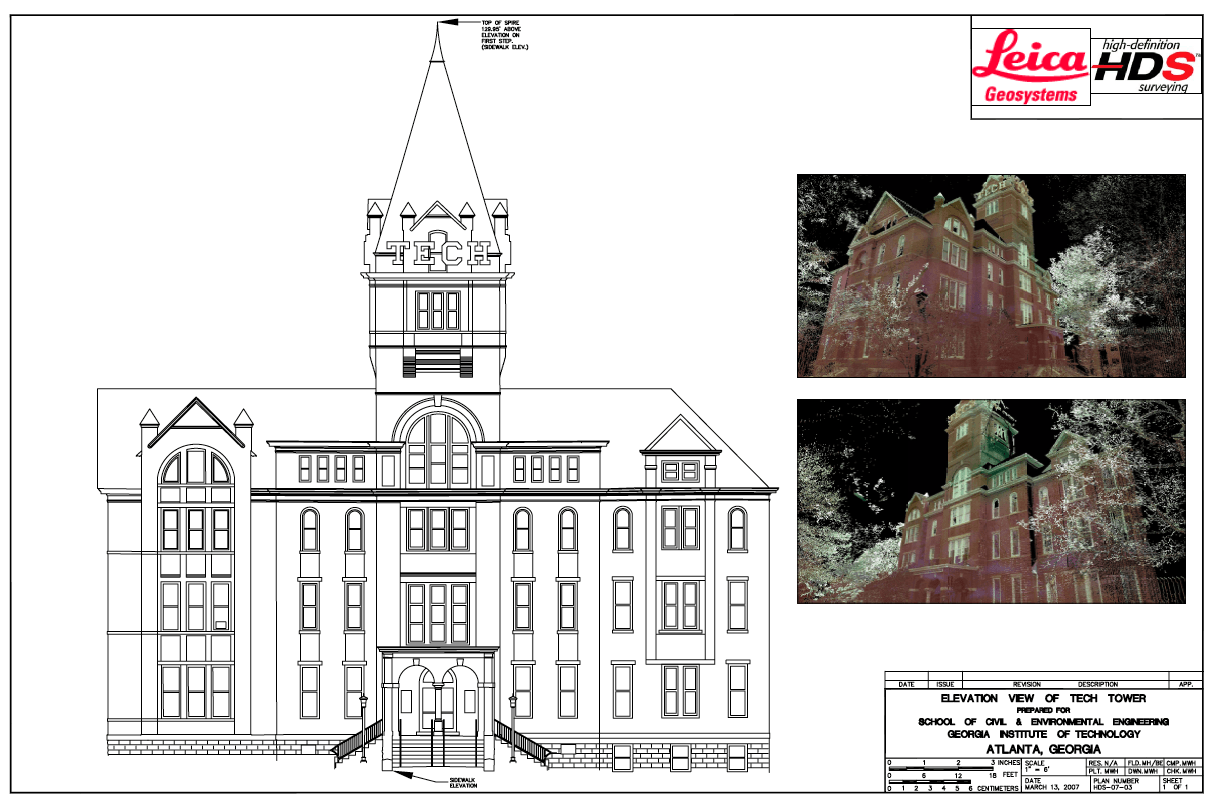

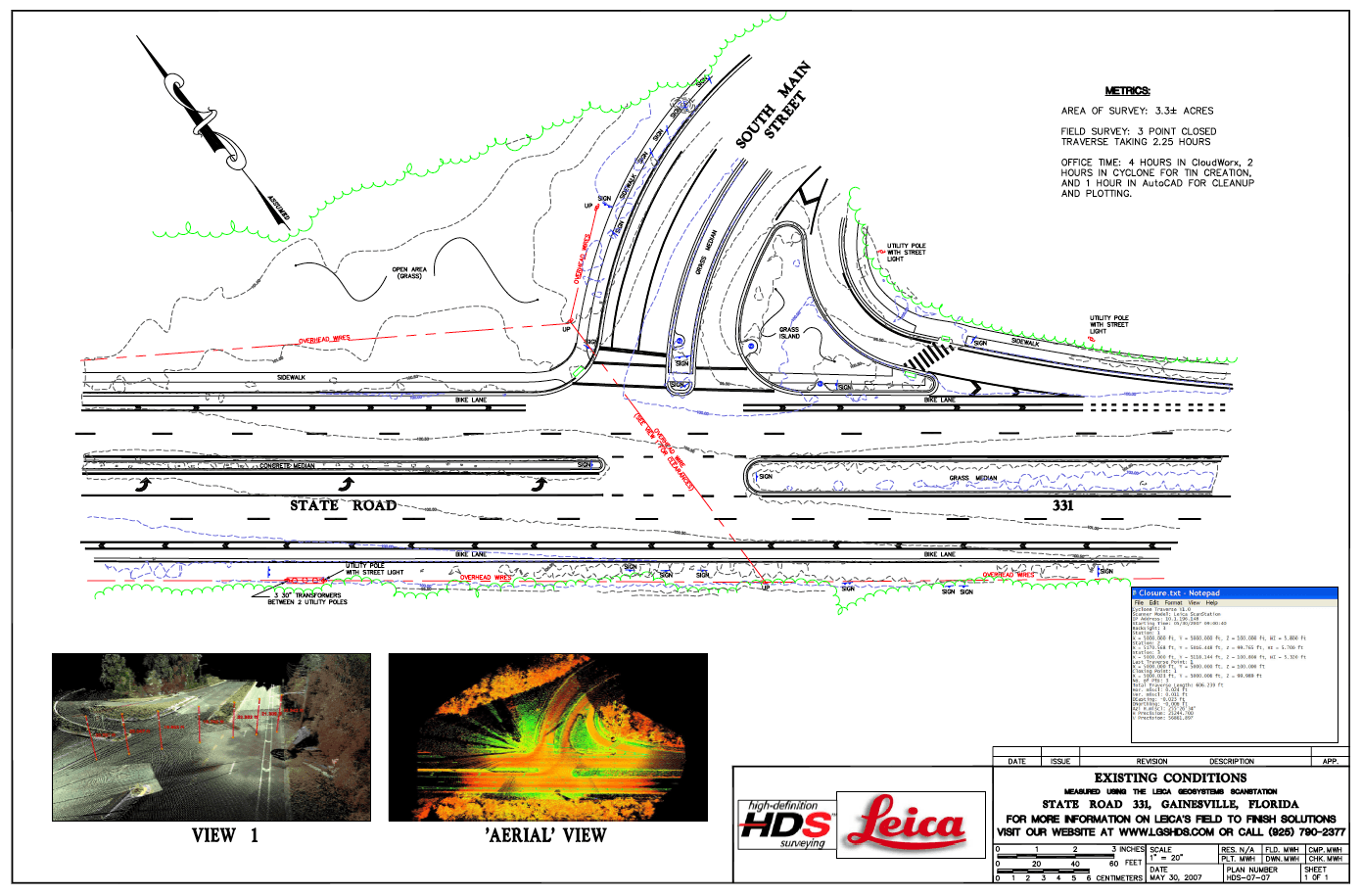

There is no such thing as the ‘magic button’ where out pops a plan. (At least not yet.) The closest thing you could get to that is using Ortho Rectified Imagery as part of your deliverable. I have seen all sorts of different types of deliverables from laser scanning data. These can range from full Topographic plans, to full 3D piping models, imagery, spread sheets, TruViews, Fly-throughs, and many more. I have attached a couple examples of deliverables that have been made from strictly scan data. The sky is the limit with deliverables. Usually, I made sure I understood what the client was expecting, and then I added just a little extra to get them to come back.

[Editor’s note: Here are the examples. Click to make them larger.]

Data Mining:

As far as I was concerned with the data, no customer had the right to tell me what tool to use on any particular job. So in some cases, a customer may not have known that I was going to use a scanner until after the data was collected. The analogy I like to use is that I highly doubt that you would bring your car to a mechanic and tell him that he can only use a hammer to fix your car. Now, back to data mining: There is enormous value in the point cloud. Especially for you! Case in point: I had a project where I scanned a parking garage. Over a time period of 14 months, I created 3 different deliverables from that 1 set of data to 3 different clients. Yes, I charged them for fieldwork every time. To me, it is what the information was worth. Furthermore, I was also able to make our company look like heroes because I was able to deliver the plans in a very short time frame.

————–

Good answer, right? Clearly, Mike sees things through a Leica lens, but much of this advice, and much of what we talked about yesterday in the webinar, is good for the use of any manufacturer’s scanner. Feel free to keep the discussion going in the comments or to email me directly with further comments if you’ve got more to say than what the comment box will allow.